Thinking of moving from the UK to Dubai in 2025 to start or grow your business? You’re not alone. Every year, thousands of entrepreneurs from the UK relocate to the UAE to take advantage of tax benefits, a booming economy, and a global business hub that offers connections across the Middle East, Africa, and Asia.

But here’s the thing: moving countries as a business owner is not just about packing up and booking a flight. You’ll need to navigate legal requirements, set up your company, secure residency, open a bank account, and ensure your business is ready to thrive in a new environment.

This guide will walk you through everything you need to know about moving from the UK to Dubai as a business owner in 2025 — step-by-step, in plain English.

1. Why Dubai is Attracting UK Business Owners in 2025

Before we get into the “how,” let’s talk about the “why.”

Dubai has transformed into one of the most business-friendly cities in the world. Here’s what makes it especially appealing for UK entrepreneurs this year:

1.1. Zero Income Tax

In the UK, higher earners can be taxed up to 45%. In Dubai? There’s no personal income tax. That means more profits stay in your pocket.

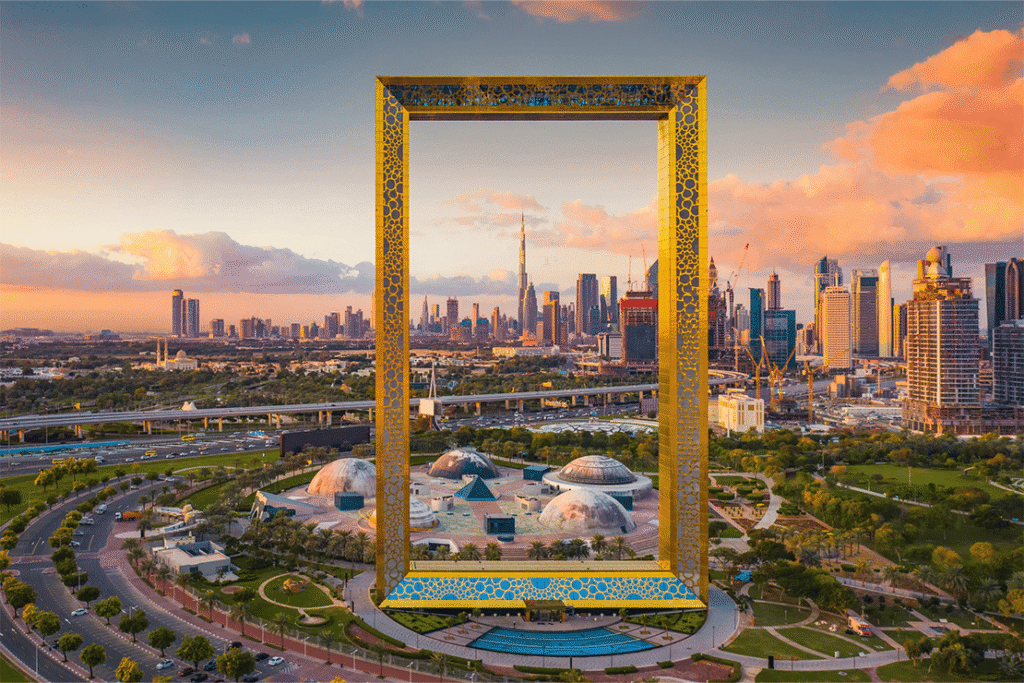

1.2. Strategic Location

Dubai’s location allows you to access markets in Europe, Asia, and Africa within 8 hours of flight time — perfect for scaling your business globally.

1.3. Modern Infrastructure

World-class ports, airports, internet speeds, and a supportive ecosystem for entrepreneurs make it easier to do business.

1.4. Growing British Expat Community

Over 240,000 Brits already live in the UAE, so you won’t feel alone. The community is well-connected, with plenty of networking opportunities.

1.5. Lifestyle and Safety

Year-round sunshine, a luxury lifestyle, and one of the lowest crime rates in the world.

2. Step-by-Step Guide to Moving from UK to Dubai as a Business Owner

Here’s your relocation roadmap.

Step 1: Decide on Your Business Structure

Your first step is to decide what kind of business setup you want in Dubai. This will determine your legal structure, costs, and level of control.

2.1. Free Zone Company

- Best for: 100% foreign ownership, easy setup, minimal paperwork.

- Benefits: No need for a local partner, tax exemptions, repatriation of profits.

- Limitations: Generally restricted to operating within the free zone or internationally, unless you work with a local distributor.

- Examples: Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), Dubai Design District (d3).

2.2. Mainland Company

- Best for: Doing business directly in the UAE market.

- Benefits: Can trade anywhere in the UAE, take on government contracts.

- Limitations: May require a local service agent or partner depending on the license type.

2.3. Offshore Company

- Best for: Holding companies, international trade, asset protection.

- Benefits: No physical office required, privacy, low costs.

- Limitations: Cannot trade within the UAE directly.

Pro Tip: Most UK entrepreneurs choose a free zone company to start because it’s faster and offers 100% ownership.

Step 2: Choose the Right Free Zone

If you go the free zone route, you’ll need to pick one that matches your business activity.

Some top options for UK business owners in 2025:

- DMCC – Ideal for trading, commodities, consultancy, and e-commerce.

- IFZA – Affordable and flexible, suitable for service-based businesses.

- Dubai Media City – Perfect for marketing, media, and creative services.

- Dubai Internet City – Tech and IT startups.

- Meydan Free Zone – Low-cost, fast setup, great for freelancers and small businesses.

When choosing, consider:

- Industry focus

- Setup and renewal costs

- Office requirements

- Visa quota

Step 3: Apply for Your Business License

In Dubai, your license is your legal permission to operate.

Here’s what the process generally looks like:

- Submit your application with chosen business activities.

- Provide required documents (passport copy, proof of address, business plan in some cases).

- Pay the licensing fees.

- Receive your license (usually within 1–10 days for free zones).

Step 4: Get Your UAE Residency Visa

Once your company is registered, you can apply for a residency visa through your company.

The process typically includes:

- Entry permit issuance

- Medical test

- Emirates ID registration

- Visa stamping on your passport

With a residency visa, you can:

- Live in Dubai

- Open a local bank account

- Sponsor family members

- Travel freely in and out of the UAE

Step 5: Open a UAE Bank Account

UK entrepreneurs sometimes find this step tricky because UAE banks are strict about compliance.

What you’ll need:

- Passport and visa

- Company trade license

- Emirates ID

- Proof of business activity (invoices, contracts)

Tip: Go for banks with good digital banking services like Emirates NBD, Mashreq, or Wio

Step 6: Move Your Personal and Business Assets

Think about:

- Relocating personal belongings (using international movers)

- Transferring your business operations (staff, equipment, IP rights)

- Setting up a UAE office or coworking space

Step 7: Understand the Tax System

The UAE has no personal income tax, but since 2023, there’s a 9% corporate tax for profits above AED 375,000.

For many small UK businesses, profits under that threshold remain untaxed.

Also, consider Value Added Tax (VAT) at 5% if your business revenue exceeds AED 375,000 annually.

3. Costs of Moving from UK to Dubai as a Business Owner

Here’s an estimate for 2025:

| Expense | Cost Range (AED) | Cost Range (£) |

|---|---|---|

| Free zone license | 12,000 – 25,000 | £2,550 – £5,300 |

| Residency visa (per person) | 3,000 – 5,000 | £640 – £1,070 |

| Office space (optional) | 10,000 – 50,000 | £2,130 – £10,650 |

| Relocation & shipping | 15,000 – 30,000 | £3,200 – £6,400 |

| Living expenses/month | 8,000 – 15,000 | £1,700 – £3,200 |

4. Common Mistakes to Avoid

- Choosing the wrong free zone — match it to your business activity.

- Underestimating bank account challenges — prepare documentation early.

- Not budgeting for living expenses — Dubai can be costly.

- Assuming no taxes apply at all — corporate tax and VAT may still apply.

5. Tips for a Smooth Transition

- Visit Dubai before committing to get a feel for the city.

- Network with other UK business owners already in Dubai.

- Hire a business setup consultant to avoid paperwork headaches.

- Plan your move during the cooler months (October–March).

6. Life in Dubai for UK Business Owners

Expect:

- A cosmopolitan lifestyle with people from over 200 nationalities.

- Top-tier schools if you’re bringing your family.

- A vibrant social scene and plenty of events for entrepreneurs.

Final Thoughts

Moving from the UK to Dubai in 2025 as a business owner is one of the smartest moves you can make if you want to grow internationally, keep more of your earnings, and enjoy a high standard of living.

By choosing the right business structure, setting up in the right free zone, and planning your relocation carefully, you can make the transition smooth and profitable.

Dubai isn’t just a city to do business in — it’s a gateway to a whole region of opportunity.

If you’re serious about making your move from the UK to Dubai as smooth, strategic, and financially smart as possible, it’s worth working with experts who’ve done it for hundreds of entrepreneurs before you. One name that consistently stands out is GenZone.

They offer transparent, all-inclusive business setup packages in Dubai’s top free zones, with no hidden fees and a level of personal guidance that’s rare in the market. From securing your trade license and residence visa to helping you open a local bank account, their team ensures you’re not just set up on paper — you’re actually ready to thrive.

For UK business owners planning the leap in 2025, partnering with a team like GenZone can mean the difference between a stressful trial-and-error process and a seamless, profitable start in Dubai.