Dubai has rapidly become the go-to hub for global companies wanting to expand into the Middle East, Africa, and Asia. Thanks to its business-friendly regulations, zero personal income tax, strategic location, and world-class infrastructure, the emirate attracts thousands of international firms each year.

For foreign businesses, one of the most effective ways to enter Dubai’s market is by opening a branch office in a Dubai Free Zone. Unlike setting up a brand-new company, a branch allows you to extend your existing foreign entity into Dubai while maintaining full ownership and control.

But how exactly does this work? What are the steps, requirements, and benefits? And most importantly, is it the right move for your business?

This article breaks down everything you need to know about setting up a foreign branch in a Dubai Free Zone in 2025—from legal structures and required documents to timelines, costs, and common mistakes to avoid.

1. What is a Branch of a Foreign Company in Dubai Free Zone?

A foreign branch is an extension of your parent company in another country. It is not a separate legal entity but an office that operates under your existing company’s name, brand, and business license.

Key points to understand:

- The parent company bears full liability for the branch’s activities.

- The branch is allowed to carry out the same business activities as the parent company (as long as they are permitted in the chosen free zone).

- It allows you to invoice clients, sign contracts, hire staff, and open a bank account in Dubai.

- Unlike forming a subsidiary, there is no share capital requirement for a branch.

👉 This makes branch offices an excellent choice for foreign companies that want a low-risk entry into Dubai without setting up an entirely new entity.

2. Why Open a Branch in a Dubai Free Zone?

Before we jump into the process, let’s explore why this structure is so attractive:

✅ 100% Foreign Ownership

In Dubai free zones, foreign investors enjoy full ownership of their branch. You don’t need a local partner or sponsor.

✅ Tax Advantages

- 0% personal income tax

- 0% withholding tax on repatriated profits

- 9% corporate tax (introduced in 2023) applies only if profits exceed AED 375,000 and meet certain criteria.

- Many free zones still qualify for exemptions based on activities.

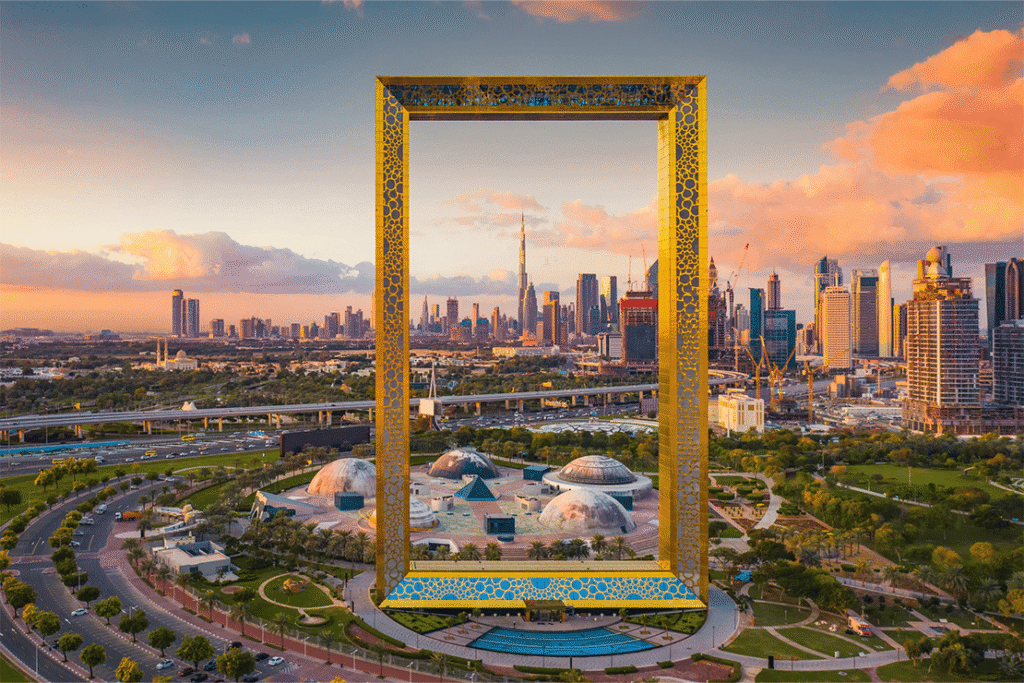

✅ Strategic Location

Dubai is a global business hub connecting Europe, Asia, and Africa. Having a branch here strengthens your international presence and makes logistics easier.

✅ Access to Banking & Payments

Opening a branch allows you to set up a corporate bank account in Dubai, making it easier to manage global transactions.

✅ Market Expansion Without Heavy Capital

Unlike starting a subsidiary, you don’t need to inject large amounts of share capital—making it more affordable.

✅ Credibility & Trust

Operating under a recognized Dubai free zone license boosts your credibility with clients, suppliers, and banks.

3. Choosing the Right Free Zone for Your Branch

Dubai has more than 30 free zones, each designed for specific industries. Choosing the right one is crucial.

Popular options include:

- Dubai Multi Commodities Centre (DMCC) → Best for trading companies

- Dubai Internet City (DIC) → Ideal for IT & tech firms

- Dubai Media City (DMC) → Perfect for media, marketing & creative industries

- Dubai International Financial Centre (DIFC) → For financial services & fintech

- Dubai Healthcare City (DHCC) → For medical & wellness-related companies

👉 Your choice should depend on your industry, target clients, and business activities.

4. Step-by-Step Guide to Opening a Foreign Branch in a Dubai Free Zone

Now let’s get practical. Here’s the exact process you need to follow in 2025:

Step 1: Choose Your Free Zone

Select a free zone that aligns with your industry. This decision impacts costs, office space, and business activities allowed.

Step 2: Get Initial Approval

Submit an application with:

- Parent company trade license

- Certificate of incorporation

- Memorandum of Association (MoA)

- Board resolution approving the branch setup

- Passport copies of directors/shareholders

📌 Note: All documents must be notarized and legalized in the home country, then attested by the UAE embassy.

Step 3: Reserve Your Trade Name

The branch typically uses the same name as the parent company. However, if the name conflicts with UAE regulations, you may need a slight modification.

Step 4: Lease Office Space

Most free zones require a physical office lease before issuing a license. Options include:

- Flexi-desk (shared office space)

- Dedicated office units

- Full commercial spaces

Step 5: Obtain the Branch License

After approvals and office space confirmation, the free zone authority issues the branch license.

Step 6: Apply for Visas

Branches can sponsor employee visas, investor visas, and dependent visas. The quota depends on your office size.

Step 7: Open a Corporate Bank Account

With your license in hand, you can open a business account with a UAE bank to handle operations.

5. Required Documents for Branch Registration

Here’s a checklist:

- Parent company’s trade license & MoA

- Board resolution approving the branch in Dubai

- Certificate of good standing (if applicable)

- Passport copies of directors & managers

- Power of Attorney appointing the branch manager

- Office lease agreement

6. Costs of Opening a Foreign Branch in Dubai Free Zone

The cost varies by free zone but generally includes:

- License fees: AED 10,000 – 20,000

- Registration fees: AED 5,000 – 10,000

- Office rent: AED 15,000 – 50,000 (depending on space)

- Visa costs: AED 3,000 – 6,000 per visa

- Document attestation: AED 3,000 – 5,000

👉 On average, expect to spend AED 40,000 – 80,000 for setup in the first year.

7. Timeline for Setting Up a Branch

- Document legalization: 2–4 weeks (depends on home country)

- Initial approval: 1–2 weeks

- License issuance: 1–2 weeks

- Total time: 4–8 weeks (if documents are ready)

8. Common Mistakes to Avoid

- Choosing the wrong free zone → limits your business activities.

- Not legalizing documents properly → causes major delays.

- Underestimating office requirements → some free zones require larger office spaces.

- Ignoring corporate tax rules → know whether your branch qualifies for exemptions.

9. Benefits of a Dubai Free Zone Branch vs. Subsidiary

| Feature | Branch Office | Subsidiary Company |

|---|---|---|

| Ownership | 100% foreign | 100% foreign |

| Share Capital Required | No | Yes |

| Legal Entity | Not separate | Separate |

| Liability | Parent company liable | Subsidiary liable |

| Business Activities | Same as parent | Independent |

👉 If you want low-cost expansion with full control, choose a branch.

👉 If you want local liability separation, choose a subsidiary.

10. Is Setting Up a Branch in a Dubai Free Zone Right for You?

Opening a foreign branch is best if:

- You already have a successful business abroad.

- You want to expand into Dubai without heavy costs.

- You want to keep all operations under the parent company’s control.

- You don’t need to diversify business activities beyond your parent company’s scope.

If you want flexibility to expand activities, a subsidiary may be better.

11. Final Thoughts

Setting up a foreign branch in a Dubai Free Zone is one of the most efficient ways to expand internationally in 2025. You gain access to Dubai’s thriving economy, global markets, tax advantages, and banking—all without the hassle of creating a brand-new company.

The process requires careful planning, document legalization, and choosing the right free zone, but with the right guidance, it can be completed in as little as 4–6 weeks.

For companies serious about international growth, a Dubai branch is not just an option—it’s a strategic advantage.

How GenZone can help?

If you’re serious about setting up a foreign branch in a Dubai free zone but want to avoid the hidden costs, confusing paperwork, and endless back-and-forth with authorities, partnering with the right experts makes all the difference.

At GenZone, they specialize in helping international businesses establish their presence in Dubai with complete transparency—no hidden renewal fees, no upselling, just straightforward guidance and full support from start to finish.

From licensing and visas to banking and compliance, their team ensures you get set up quickly and efficiently so you can focus on scaling your business in one of the world’s fastest-growing hubs.